You may be familiar with President Biden’s Fiscal year 2025 budget proposals that raise capital gains rates to the highest percentage since its inception. I’ve sat down with my Joint Economic Committee staff to discuss what this looks like for hardworking, taxpaying Americans. Here’s what our main observations consisted of:

The issue with Capital Gains Tax is that the tax is paid on realizations, (say, when you sell the asset) meaning a high tax rate would not only discourage people to invest, but also would discourage those with appreciated assets, not to sell them.

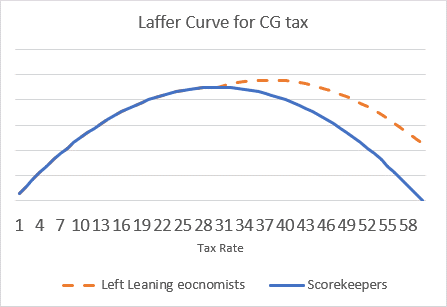

Economists from the left believe that these realizations are less elastic, so you can raise capital gains tax to 40-47% to maximize the revenue from this tax. This paper represents this vision as it was written by Larry Summers and Natasha Sarin. Their statements rail against the ‘scorekeepers’ (JCT, CBO, Tax Policy Center, Tax Foundation, Penn Wharton Budget Model) who estimate the maximum revenue capital gains tax to be around 30%.

Their observations and claims run a direct contradiction to the facts that long term investments are actually elastic to taxes. Investing is using existing capital to maximize profit, and this capital is usually very mobile. A large tax hike will incentivize investors to invest in portfolios taxed at a lower rate, delay realizations, change their attitude to risk, sell their capital to tax-exempt organizations or foreigners, or just sit on their capital without investing it. All these examples actually discourage domestic savings and slow down the economy. Moreover, if the problem is that some individuals pay rates way below the maximum statutory one, raising the statutory rate would not affect them as much as it would affect those who are not practicing tax avoidance (and might draw some of them to do it as well).

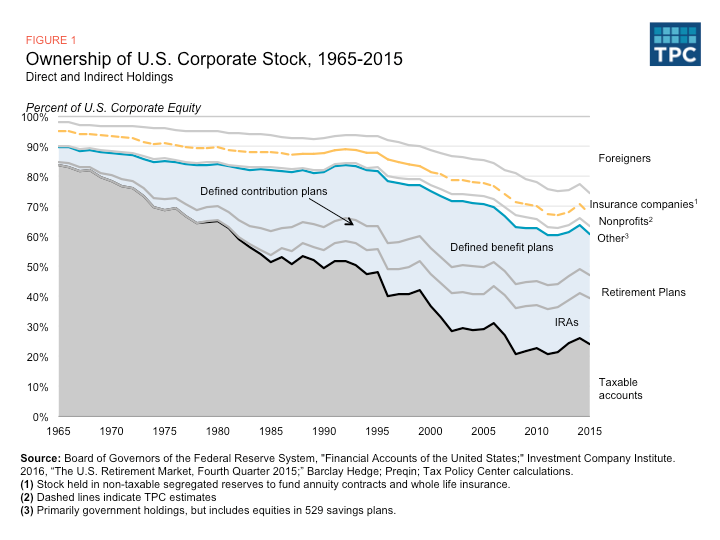

Those not reacting tend to be non-taxable ones, which represent over 70% of all holdings Only About One-Quarter of Corporate Stock is owned by Taxable Shareholders. | Tax Policy Center (note: the data of this article is a little bit old. I need to recalculate it)

Jessica York with the Tax Foundation proposes a good summary about Capital Gains Tax, explaining why it implies double taxation and how the revenue of this tax has been going up only when the rates were cut.

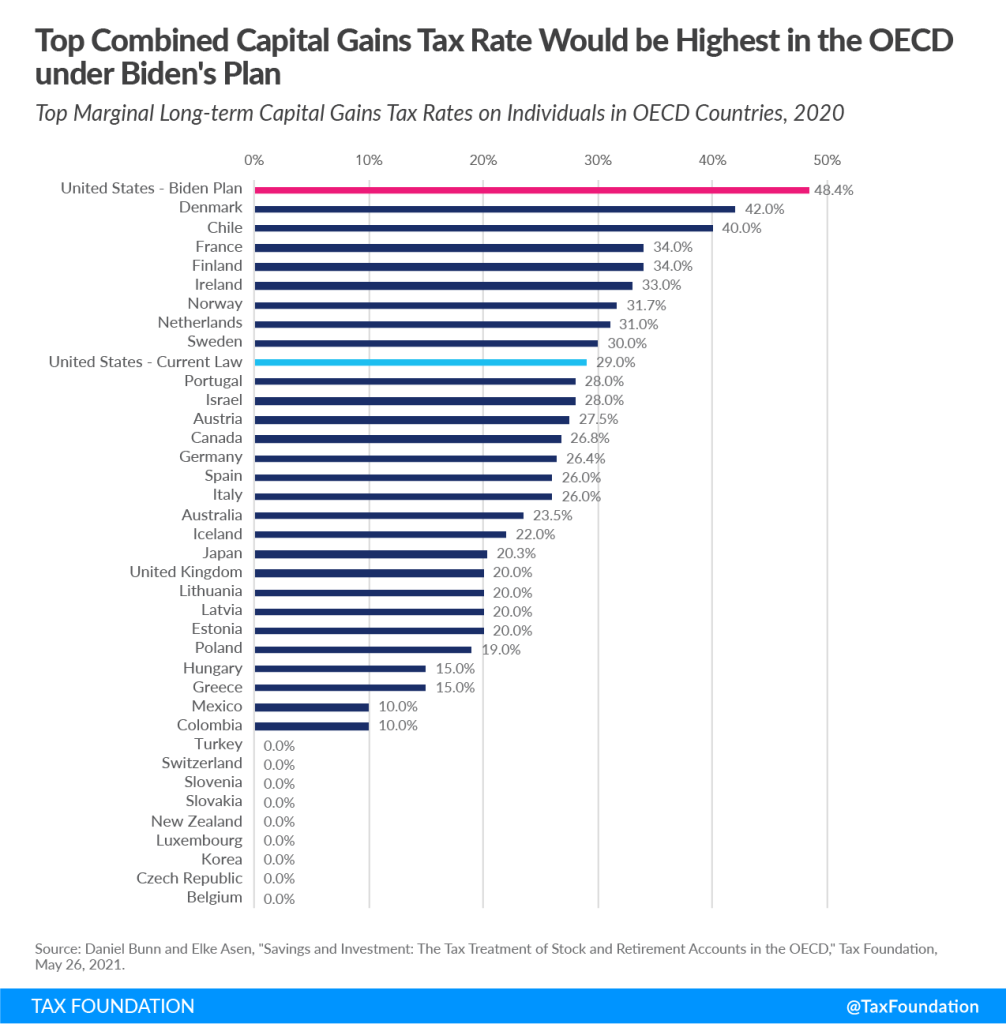

Another important factor to note is having to add Federal and State. This article outlines some previous rates (2021), but it clearly shows that for a more modest hike as the one proposed under Build Back Better (31.8%), some states would’ve faced combined capital gains tax of over 40%. If we used a similar logic to the rate just proposed, it would go over 50%. These figures align with the numbers from Americans for Tax Reform observations. (Click here for a map of the current state rates, not in combination with current federal rates.)

You might notice that this proposal reflects the numbers from 2021, with a top rate of 39.6% and a net investment income tax of 5%, making it to 44.6%. Piggybacking on previous analysis, when comparing the United States to the OECD, after adding the average state rate, the United States has a maximum rate of about 29%, which is above the OECD average, but of 48.4%, which is 6% higher than Denmark, making it the highest in the OECD. This difference is wider if we add the current corporate tax rates.

Martin Feldstein, chairman for the Council of Economic Advisers under the Reagan Administration has a less technical paper on the negative effects of taxing capital gains (and corporate) at a high rate.

Economists at Tax Policy Center (Urban-Brookings) tend to be skeptic of proposals at such high rate. They put the maximum rate at 28%.

Note that the proposed changes also include taxing unrealized capital gains at death over $5 million. This is because there is a loophole by which the gains on the capital are reset once a person inherits the asset. Therefore, a gain never realized (or sold immediately after the death of the previous owner) would never pay taxes. This is something proposed by liberal-leaning economists, but Biden’s budget limits it to unrealized capital at death. Actually, some believe that this provision could raise the maximum rate, as investors don’t have an incentive to keep assets that would be tax free to their inheritors. Of course, this is not taking into account the effects on the economy in general– especially when coupled by other changes affecting returns to investment (like raising corporate tax rates on one side, and also taxing alternative uses for the capital).