WASHINGTON, D.C. — “With just $4 billion in cuts— equal to less than a single day’s worth of borrowing— the Senate…

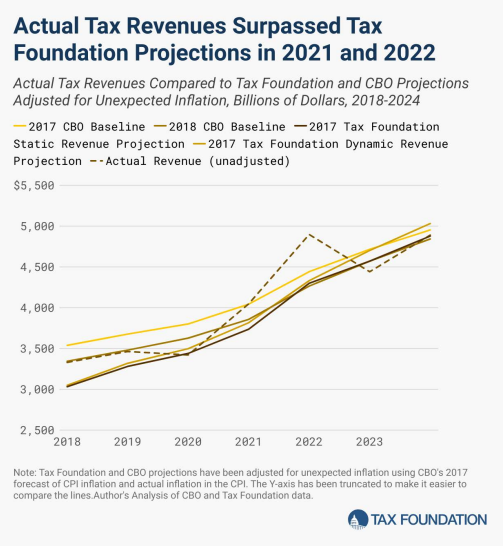

Since I was first elected to Congress, my mission has always been to help Arizona families. I believe through stopping wasteful government spending and bringing forward measures that help create good-paying jobs and shrink our debt, we can build a healthier economy and secure the economic future of America’s children. I was proud to help write the Tax Cuts and Jobs Act, legislation that was signed into law in 2017. This legislation was one of our country’s most sweeping overhauls of the federal tax code in over three decades.

Each year after passage of the bill we have consistently seen great news for the economy. Prior to the pandemic, our monthly jobs reports were showing record-low unemployment, thousands of jobs created, and increased wages across the spectrum, particularly for minority groups and women. It is imperative for us to be promoting pro-growth policies like tax cuts to help drive economic growth, as well as ensure that our tax code works for our nation’s families and keeps the United States economy competitive.

H.R.8293, American Donor Privacy and Foreign Funding Transparency Act

H.R.7425, To amend the Internal Revenue Code of 1986 to provide a deduction for certain newborn expenses. (The Family growth & Investment Act)

This bill allows individual taxpayers a tax deduction from gross income (above-the-line deduction) through 2029 for their qualified newborn expenses, up to $5,000. The deduction is not available for taxpayers whose modified adjusted gross income exceeds $100,000 ($200,000 in the case of a joint return).

The bill defines qualified newborn expenses to include amounts paid for infant formula, baby bottles, diapers, infant car seats, baby strollers, and cribs.

Taxpayers must include their social security number on their tax returns to qualify for the deduction.

H.R.3991, Small Business Paperwork Savings Act

This bill increases from $600 to $5,000 the threshold for reporting income for tax purposes.

H.R.1262, CCU Parity Act of 2023

This bill increases the tax credit for carbon capture and use to match incentives for carbon capture and sequestration for both direct air capture and the power and industrial sectors.

H.R.8214, Permanent Extension of Rate Cuts and Extension of National Tax Simplification Act of 2022

This bill makes permanent provisions in Public Law 115-97 (also known as the Tax Cuts and Jobs Act) relating to individual taxpayers, including the modification of individual income and capital gains tax rates and the increased exemption for the alternative minimum tax. It also increases the standard tax deduction and repeals the limitation on itemized tax deductions.

H.R.2943, To amend the Internal Revenue Code of 1986 to allow retroactive elective deferrals for owners of unincorporated businesses in the case of a plan adopted after the close of the taxable year and before the time for filing the return of tax.

This bill allows sole proprietors a retroactive elective deferral under a tax-exempt retirement plan that is adopted after the close of the taxable year and before the time for the filing of the individual’s tax return. The elective deferral is treated as made prior to the end of the plan’s first plan year.

An elective deferral is an amount contributed to certain tax-exempt retirement plans (e.g., 401(k)s, 403(b)s, SIMPLE pension plans and IRAs) by an employer at the employee’s election and which, except to the extent they are designated Roth IRA contributions, are excludable from the employee’s gross income.

H.R.2942, To amend the Internal Revenue Code of 1986 to increase the catch-up contribution limit for retirement plans of participants age 62 through 64.

This bill increases the amount of the catch-up contribution available to participants in certain tax-exempt retirement plans who have attained age 62, 63, or 64.

H.R.2633, To amend the Internal Revenue Code of 1986 to increase and expand the credit for carbon oxide sequestration.

This bill modifies the tax credit for carbon oxide sequestration. It increases the applicable dollar amount of such credit, repeals the placed-in-service deadline, expands the types of facilities to which the credit applies, and extends the credit period from 12 to 20 years.

H.R.2165, Exit Tax Prevention Act of 2021

This bill prohibits a state, or taxing jurisdiction in the state, from imposing an income tax, wealth tax, or any similar tax on a resident who has relocated permanent residence to another state or taxing jurisdiction.

H.R.601, Invest Now Act

This bill reduces to 5% the capital gains tax rate for property purchased in 2021 and held by the taxpayer for more than five years.

H.R.7714, To amend the Internal Revenue Code of 1986 to reduce the floor on the deduction for medical expenses.

This bill makes permanent the reduction in the adjusted gross income (AGI) threshold that must be exceeded before a taxpayer may claim a deduction amount for medical expenses. The reduction is from 10% to 7.5% of AGI and 5% in any taxable year beginnning in 2020 or 2021.

H.R.7658, To provide a payroll tax credit for certain costs of providing employees with testing for COVID-19.

This bill allows employers a payroll tax credit for 50% of employee testing expenses for COVID-19 (i.e., coronavirus disease 2019). The credit does not apply to the federal government or any state or local government.

H.R.5883, To amend the Internal Revenue Code of 1986 to provide for an increased credit for carbon oxide sequestration for direct air capture facilities, and for other purposes.

This bill provides for an increased carbon oxide sequestration tax credit for direct air capture facilities.

H.R.3587, To amend the Internal Revenue Code of 1986 to modify the effective date for the modification to net operating loss deductions in Public Law 115-97.

This bill amends the Tax Cuts and Jobs Act of 2017 (P.L. 115-97) to provide that the net operating carryforward and carryback modifications in that Act are effective for net operating losses arising in taxable years beginning after December 31, 2017 (instead of tax years ending after December 31, 2017).

The bill also allows an extension of the deadline for filing an application for a tentative carryback adjustment for net operating losses arising before January 1, 2018, and ending after December 31, 2017.

H.R.1328, Denying Amnesty Bonuses Act

This bill amends the Internal Revenue Code to deny the earned income tax credit to a taxpayer or a taxpayer’s spouse who, in any taxable year, received temporary deportation relief and work authorization in accordance with any program not specifically established by Congress.

H.R.6088, TRUTH Act of 2012

Total Repeal of the Unfair Taxes on Healthcare Act of 2012 or the TRUTH Act of 2012 – Amends the Internal Revenue Code, with respect to health care provisions added by the Patient Protection and Affordable Care Act (PPACA) and the Health Care and Education Reconciliation Act of 2010, to repeal: (1) the excise tax on the excess benefit from certain high cost employer-sponsored health coverage plans; (2) the excise tax on net investment income in the Medicare taxable base; (3) the prohibition against payments from health flexible spending arrangements, health savings accounts (HSAs), and Archer medical savings accounts (MSAs) for over-the-counter drugs; (4) the increased penalty on distributions from an HSA or Archer MSA not used for qualified medical expenses; (5) the limitation on annual salary reduction contributions by an employee to a health flexible spending arrangement under a cafeteria plan; (6) the increase in the income threshold for claiming an itemized deduction for medical expenses; (7) the excise tax on indoor tanning services; (8) the requirement that individuals maintain minimal essential health care coverage; and (9) the excise tax on medical devices.

Repeals provisions of PPACA that require: (1) annual fees on branded prescription drug manufacturers and importers and on health insurance providers, and (2) a report by the Secretary of Veteran Affairs (VA) on the effect of fees assessed by such Act on the cost of medical care provided to veterans and on access by veterans to medical devices and branded prescription drugs.

As we head into the 2025 tax cliff, it’s imperative we examine matters affecting an estimated 18.7% (JCT), with some estimates as high as 36% (McKinsey), of the American workforce participating in the gig economy.

The United States has a long history of encouraging entrepreneurship, business creation, and innovation.

American ingenuity is best served when the government allows the mom-and-pop shop, as well as the budding entrepreneur, to strike out on their own and create something new and valuable, ultimately driving economic growth.

Nonstandard or alternative work arrangements—gig workers, independent contractors, freelancers, the self-employed, and remote workers—continue to rise in the post-COVID world.

Workers want autonomy, flexibility, and the opportunity to supplement income. Small businesses want the flexibility to boost productivity and innovation alongside the certainty in tax compliance to avoid penalties and fines.

The New Economy Tax Team, under the leadership of Congressman David Schweikert, is upholding the promise of Ways and Means Chairman Jason Smith in identifying and developing legislative proposals that build on the success of the Tax Cuts and Jobs Act while devising a tax code that puts the ‘New Economy’ in a position to benefit communities and workers in across the country.

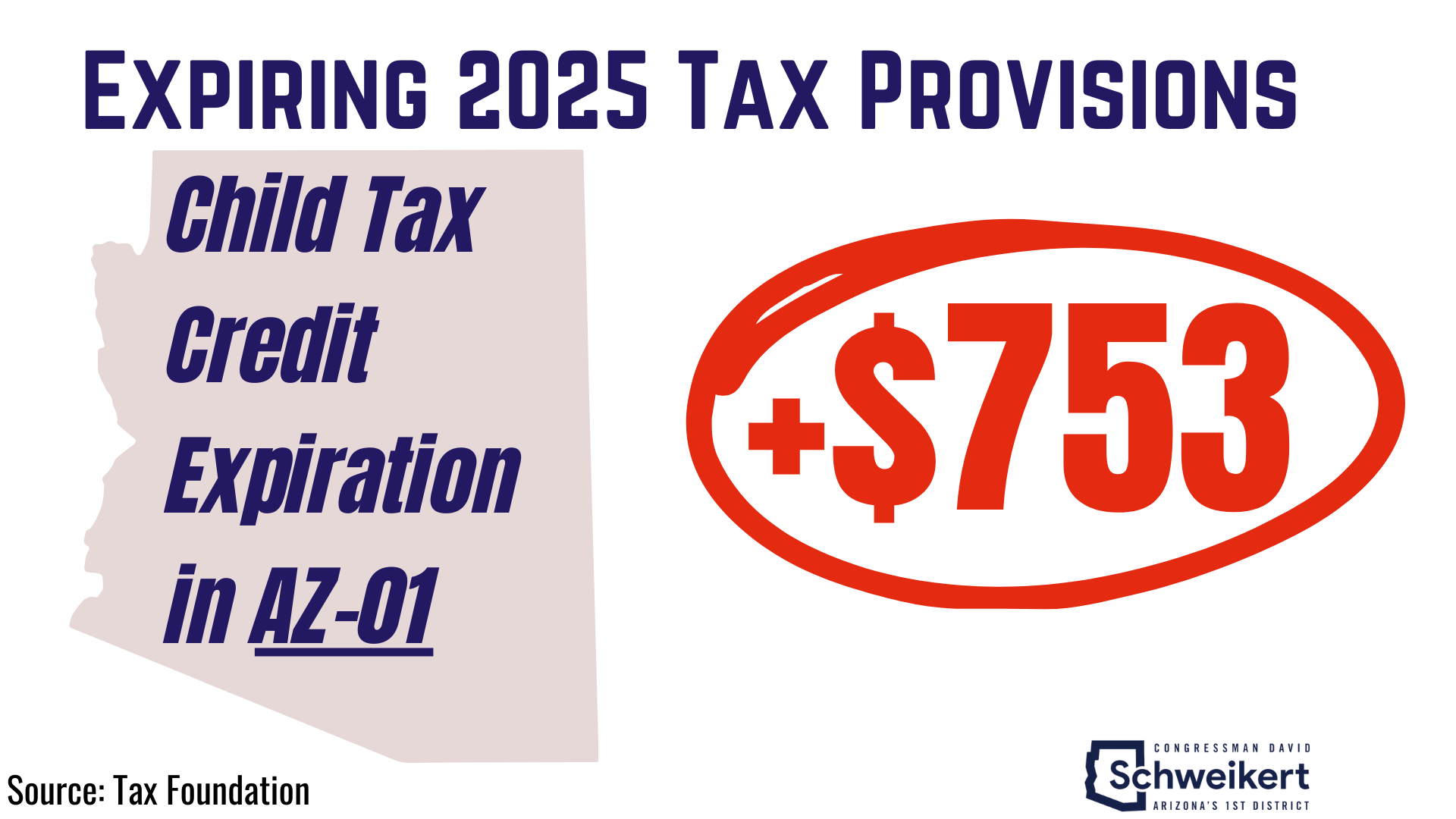

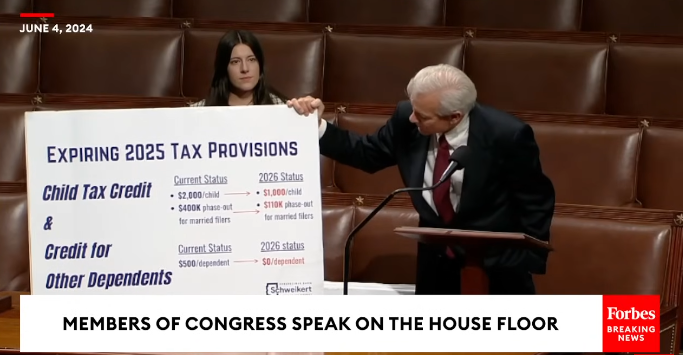

With the 2025 tax expirations around the corner, the Tax Foundation released two resources—an interactive congressional district map and an alternative tax reform options paper—that will help inform policymakers about the Tax Cuts and Jobs Act expiration’s impact on taxpayers and tax reform options to alleviate the coming tax increases.