I wanted to set the record straight on common misconceptions I’ve heard both in Washington, Arizona, and beyond. My goal is to ensure that AZ-01 can differentiate the facts from pure falsehoods. This page is dedicated to all the false claims proposed in my weekly newsletter and the counter fact with sources. If you have any suggestions on what I should fact-check next, submit your request by navigating to the ‘Contact’ page.

Monday, March 17

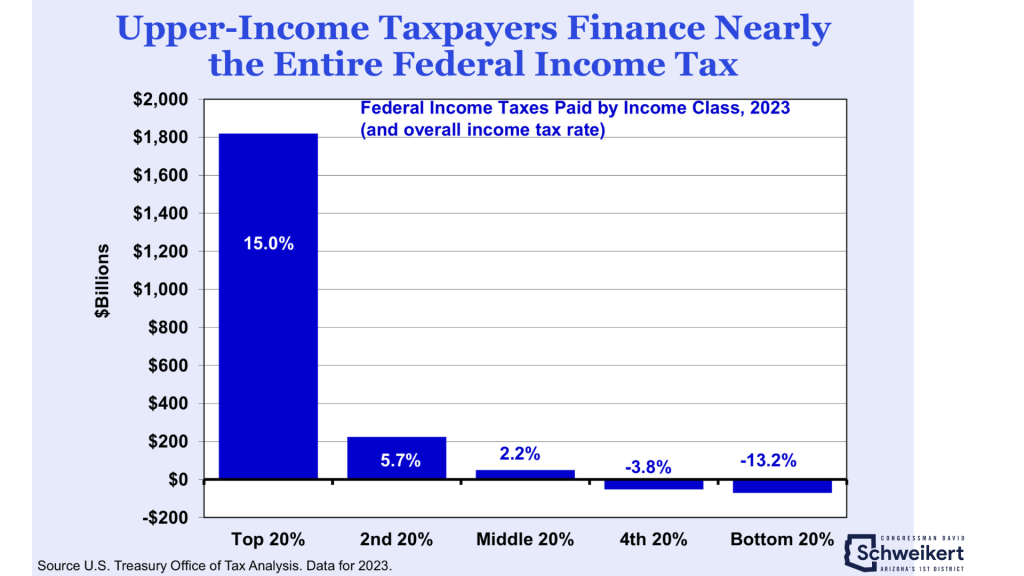

Fiction: “Rich people paying their taxes will cover A LOT of this debt!” “Rich people need to give their fair share!” “If we just taxed rich people more then we wouldn’t have any debt!“

Fact: Today, right now, if you look at the top earners, they are paying the vast majority. Let’s actually go even further; specifically, there is a perception that high-income individuals pay less than their “fair share.”

In 2019, the top 1 percent paid over 20 percent of all Federal taxes and almost 40 percent of all income tax. Notably, the Tax Cuts and Jobs Act of 2017 (TCJA) made the U.S. tax code more progressive. The same data from Congressional Budget Office (CBO) show that the ratios of Federal tax liabilities paid by the upper percentiles was higher in every year after the passage of the law in 2017.

Moreover, CBO estimates that, while the top quintile earns almost 60 percent of all income, after taxes and transfers that percentage drops under 50 percent, while every quintile in the bottom 80 percent sees an increase in their shares.

In a House Floor speech last May, I addressed the notion of taxing individuals earning over $500,000 annually at the maximum contribution level. Even if the government were to confiscate all income above this threshold, it would only raise about 5.1 percent of the economy’s GDP.

The punchline remains the same: such measures would generate insufficient revenue and could negatively impact economic growth. Policies such as targeting the top two percent of income earners would be insufficient to address the projected budget deficits. Relying solely on this demographic for increased tax revenue is doesn’t come anywhere close to financing our federal deficit, given the scale of the problem.

Floor speech:

Schweikert, D. (2024, May 9). We’re living through the largest tax hike in modern history. U.S. House of Representatives. https://schweikert.house.gov/2024/05/09/schweikert-were-living-through-the-largest-tax-hike-in-modern-history

Joint Economic Committee Report:

Schweikert, D. (2024, June). JEC Vice Chairman Schweikert releases Republican response to Economic Report of the President. Joint Economic Committee, U.S. Congress. https://www.jec.senate.gov/public/index.cfm/republicans/2024/6/jec-vice-chairman-schweikert-releases-republican-response-to-economic-report-of-the-president