WASHINGTON, D.C. — Arizona Congressman David Schweikert delivered his weekly House Floor speech highlighting the urgent fiscal crisis facing the United States, with a focus on the nation’s skyrocketing debt, unsustainable spending patterns, and demographic challenges. The potential of debt exceeding 155 percent of GDP by 2035, with annual interest payments alone surpassing $2 trillion, should petrify every American. The risk posed by rising interest rates could result in 45 percent of all U.S. tax revenues going just toward interest payments. Let’s not forget the additional $5.5 trillion in debt plus $1.3 trillion in interest from extending the 2017 tax cuts without an offset by spending cuts. Rep. Schweikert framed fiscal responsibility as a moral obligation to future generations, warning that without immediate action, the U.S. faces a potential economic collapse driven by debt, interest burdens, and demographic decline. Click the video to view the full speech or see below for some of Rep. Schweikert’s remarks.

On unsustainable growth of the U.S. national debt and its alarming impact on the economy:

[Beginning at 01:21]

“September 30– the end of this budget year– United States debt, [according to the] Congressional Budget Office, is projected to be $37.2 trillion. Ok. They’re projecting over the next ten years, we add another $20 trillion. If you then, on top of that, work [in] these provisions of the 2017 tax reform that are expiring at the end of this year, if you go take it to 2035– because that’s sort of the 10-year window, nine budget years– it’s another $5.5 trillion. Then, you add on to that, the interest. It turns out if you were to finance it– not pay for any of it– that’s another $1.3 trillion on top of that. Then, if you were to come in here and then take the president’s requests– because we have a couple of members here [saying], “Just do everything! Make everyone happy.” Screw my retirement, the next generation. America will be fine. You add it all up, by 2035, you have over $74 trillion in debt. You’re somewhere in the 155 percent or so range of the entire economy [being] borrowed. Today, we’re a little less than 100 percent.”

On looming insolvency of Social Security due to the unwillingness to confront harsh fiscal realities:

[Beginning at 14:26]

“In 2033– because what was done in this body in lame-duck, where we took another couple billion dollars out of Social Security and paid it out without replacing the money, looks like the number is mid-2033– the Social Security trust fund is empty. Now the law for Social Security says you cut seniors’ benefits; the math is about 20 percent. So, we will double senior poverty the following year, but that’s not how CBO is forced, under the law, to do the math. There’s an actual law that says you are not allowed to show a zero balance. That means in 2034, there is $600 billion dollars of borrowing that is shoved in to make up [for] the shortfall in Social Security. If you add up 2023, 2024, and 2025, that’s another $1.7 trillion because the Social Security [trust fund] is empty. And you don’t want to double senior poverty, but we are also far too fearful to actually tell the voters the truth. And every time one of us idiots– AKA, me– tries to stabilize the Social Security trust fund, that side starts running attack ads on you because they care more about winning the next election than they do doubling senior poverty in America. It is absolutely immoral.“

On the insignificance of small budget cuts in addressing the massive scale of the national debt:

[Beginning at 18:18]

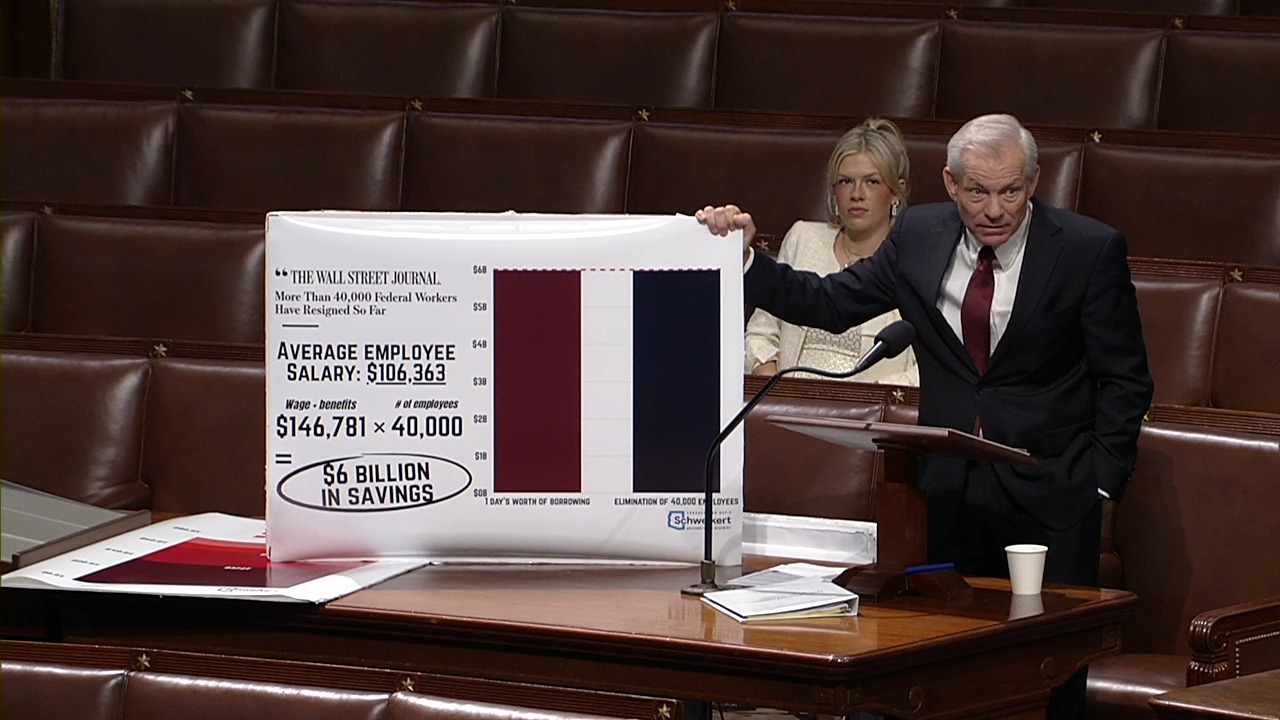

“Wall Street Journal said yesterday there are 40,000 federal employees who have said they’ll take a retirement package. Ok– if they took the package today and would get paid through the rest of the year– just ignoring that math right now. What if 40,000 federal employees, times an average salary– we used $106,000, which we got from one of the reports, and you just multiply that– and understand, this is the conservative number, we are borrowing $6 billion a day. Those 40,000 employees leaving [amounts to savings equal to] a single day of borrowing. For an entire year, all of those folks leaving [saves] a single day of borrowing. You got 24 hours of borrowing by 40,000 federal employees leaving. Yet, I watched someone on television last night saying, “Well, look, we are going to make a huge dent in the U.S. deficit with the 40,000 taking early retirement.” It’s one day of borrowing. That is not spending, that’s borrowing. Remember, by the end of the decade, that borrowing is up dramatically. Take this in. This is one of the “grand” solutions. The point I want to make is you probably have to do it, but you have to do all of them. It’s going to be dozens and dozens and dozens of things all stacked up just to provide stability. Can we, as a country, get back to just borrowing three percent of our economy a year, instead of seven percent, God forbid– over a decade from now– nine percent? You have to stop lying to each other. Our staff has to stop lying to us. The press has to stop making crap up and have to help get the public to understand the scale of what’s going on. 40,000 employees taking early retirement; the salary savings is one day of borrowing.“

| Congressman David Schweikert serves on the House Ways and Means Committee and is the current Chairman of the Oversight Subcommittee. He is also the Chairman on the bicameral Joint Economic Committee, Chairman of the Congressional Valley Fever Task Force, and is the Republican Co-Chair of the Blockchain Caucus, Telehealth Caucus, Singapore Caucus, and the Caucus on Access to Capital and Credit. |

Copyright © 2023 Congressman David Schweikert, All rights reserved.

You’re receiving this e-mail because you opted in with our staff.

Our mailing address is:

Congressman David Schweikert

166 Cannon House Office Building

Washington, DC 20515-0001

Add us to your address book

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list.