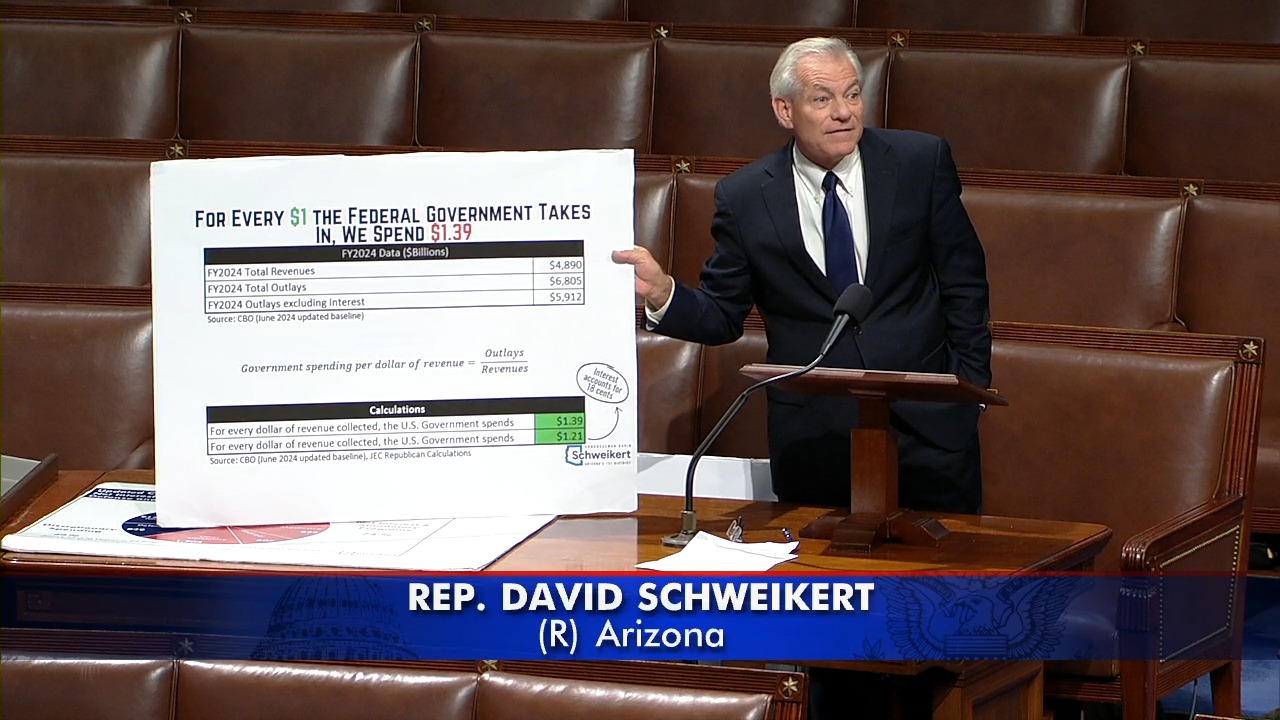

WASHINGTON, D.C. — U.S. Representative David Schweikert (AZ-01) took to the House floor yesterday to deliver his last speech before the 2024 election. He started by mentioning that the world has now surpassed the cumulative record of governmental debt, totaling an astonishing $312 trillion. Rep. Schweikert references previous floor speeches where he points out that every tax proposal for the wealthy only brings in 1.5 percent of GDP. He presents an additional hypothetical if Congress were to cut discretionary spending (which accounts for $860 billion) by $300 billion. With the combination of every Democrat tax proposal and every Republican cut, that still only gets 2.5 percent of GDP. All of this borrowing, mind you, comes in a good economic year, where tax receipts are up. We are still going to borrow almost 7% GDP.

Excerpts from Rep. Schweikert’s floor speech can be found below:

On other countries bond rates’ being cheaper than the Unites State’s rates:

[Beginning at 02:12]

“Congress has made the decision that those who are really running this government, those who run this country, will be called the ‘bond market’. Because, if you need to refinance, like we did this fiscal year, we’ve refinanced about $8 trillion and [brought] to market an additional $2 [trillion]. You’re basically sitting on $10 trillion, and that’s not even counting the short term where it was a thirty-day, [and then] six months… those things that had to be rolled. You are subject to the fragility of the bond market, and what interest rate, and how much liquidity… and how many idiots like me come behind these microphones and try to explain the world debt markets to you? Take it seriously, it is not a game. United States is now #14 on the credit stack. That means there [are] 13 other countries today that can sell a ten-year bond cheaper than us. Greece, today, can sell 10-year bonds cheaper than the United States. Think about that.”

On the morality of more cures coming to market:

[Beginning at 09:04]

“Remember: in 15 years, the United States has more deaths than births. We are about to have the fifth year where prime-age males are dying younger. In the last six years, 390,000 Americans have died from fentanyl. Well, it turns out, next year, we might have a fentanyl vaccine. And you might not like it… 390,000 have died in six years! You’re not willing to deal with the moral imperative of saving our brothers and sisters?! We need to think differently. And the fact of the matter is, you are living in a time of miracles. We can cure Hepatitis-C, we can cure hemophilia. There are things that are coming out. There [are] the Vertex experiments that look to cure Type 1 diabetes. If diabetes is 33% of all U.S. health care spending, what is the morality, but what’s also the amazing economics if we would fixate– in the Farm Bill, in nutrition support– in the way we deliver health care to get our brothers and sisters healthier? Turns out, it is the single biggest thing you can do to stabilize U.S. debt. How many people have you heard come behind these microphones within the last year, and be willing to say that? Because you upset the lobbyists, walking up and down the hallways, that need people that are sick!”

On the reiteration that interest is the second biggest expenditure of U.S. government spending:

[Beginning at 17:30]

“If you actually care about the debt, stop living in this fantasy; “We’ll just tax rich people, and that takes care of everything!” If you look at some of the proposals, they’ve already spent the money three or four times. I keep trying to present over and over; when you start to realize the amount of our spending– and by the end of the decade, think of this, 10 years from now– if you add in the debt we will owe to the trust funds, what’s left of them, we’re at $56 trillion. $56 trillion! What happens if interest rates move against us? Remember, interest today is the second biggest expenditure in this government. [Number one is] Social security. Behind that is interest. Then Medicare, then defense. Defense is now the fourth [largest] expenditure in this government. And you try over and over and over. You see right here– 2024-2025– the little, tiny movement we get in 2026 and a couple years after that, and then, boom! Now, this here is because the tax hikes that are coming– they’re already in statute, they’re coming. It’s not a vote, we’re not taking a vote to say we’re going to raise these taxes. It’s called tax expiration. It’s already coming. It’s math– But boom. After three or four years, you’re back, and the curve is back in. We don’t want to tell the truth: it’s demographics“

###

Congressman David Schweikert serves on the House Ways and Means Committee and is the current Chairman of the Oversight Subcommittee. He is also the Vice Chairman on the bicameral Joint Economic Committee, chairs the Congressional Valley Fever Task Force, and is the Republican Co-Chair of the Blockchain Caucus, Telehealth Caucus, Singapore Caucus, and the Caucus on Access to Capital and Credit.