WASHINGTON, D.C. — U.S. Representative David Schweikert (AZ-01) delivered a speech on the House Floor last night to draw attention to federal borrowing costs approaching $100,000 per second since the start of FY24 on October 1. Rep. Schweikert also noted that the national debt has increased by $2.2 trillion since the passage of the Fiscal Responsibility Act, and without significant policies to stabilize the debt-to-GDP ratio, the nation’s fiscal health will continue to unravel.

Excerpts from Rep. Schweikert’s floor speech can be found below:

Click here or on the image above to view Rep. Schweikert’s remarks.

On borrowing costs nearing $100,000 per second since the start of FY24:

[Beginning at 1:25]

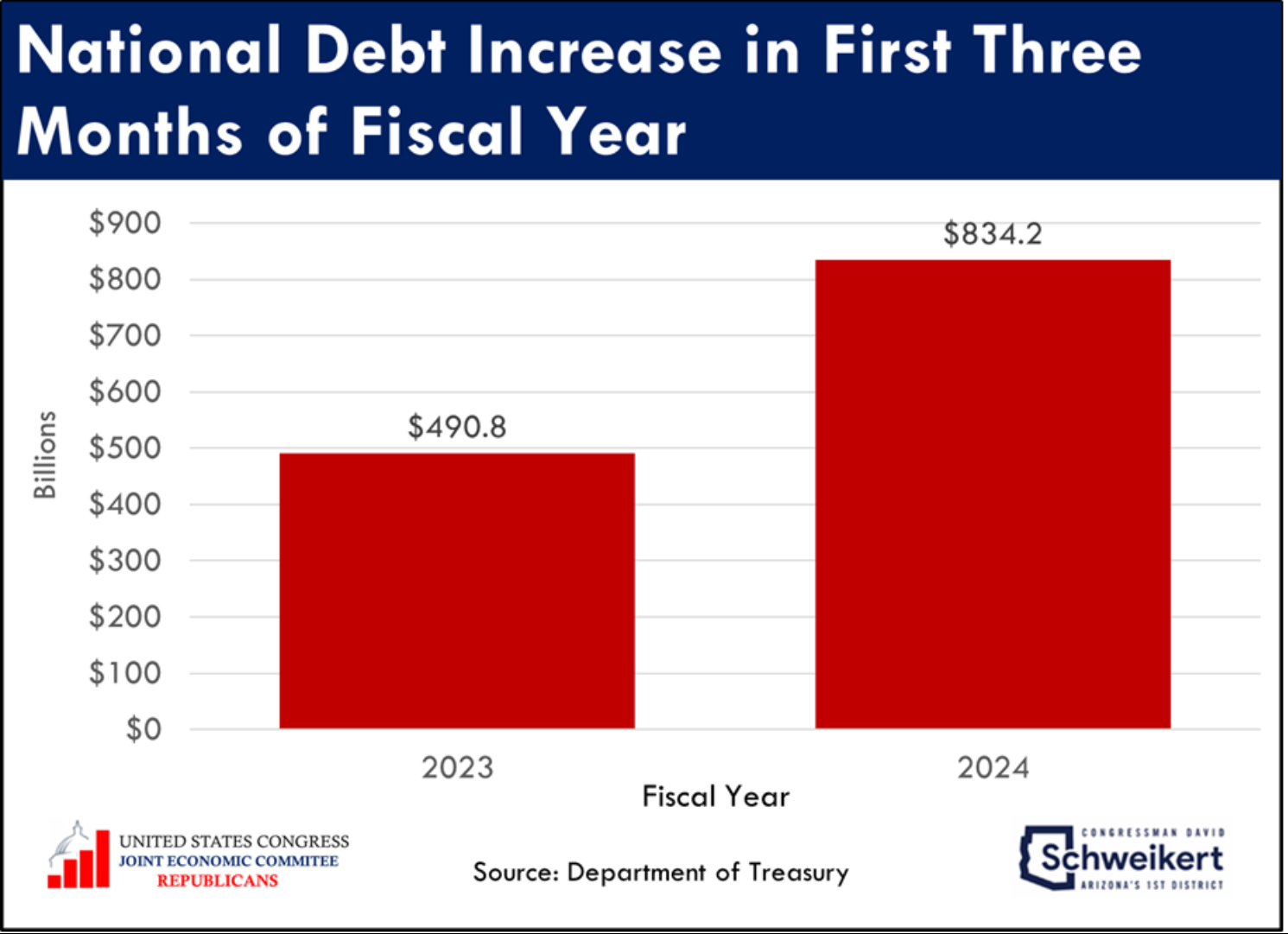

“We’re a little over one quarter into this fiscal year. If you add up everything, we’re borrowing about 9.6% of the economy. In the last 365 days, we borrowed 8.4% of the entire GDP. Does anyone see a math problem? This is my frustration. The border [is] incredibly important, getting these budget bills done [is] incredibly important. But the house is burning down around us.

[…]

“Over the last 365 days, we are borrowing $83,377 every second, and if you do just this fiscal year, [we’re borrowing] $99,480 per second.”

On the rapid increase in the national debt since the passage of the Fiscal Responsibility Act:

[Beginning at 11:03]

“We burnt this place down last June. We did the debt ceiling agreement. We actually got some spending cuts. […] and a little while after that, we removed our Speaker. We basically weren’t able to do anything for months. What was the debt of the United States when we did that debt ceiling deal? It was $31.8 trillion. We made a big deal. We got rid of a speaker. We did all these other things. How much progress did we make since then? Come on. A lot of people got television time screaming about this. Well, let’s see. We [reached $34 trillion in debt] last week. [We’ll hit $35 trillion] this April. Done great, guys. We don’t seem to understand 100% of the debt that is growing from today through the next 30 years — and this really makes people uncomfortable — 100% is demographics. It’s the interest, it’s health care costs. And in about 8 or 9 years, we are going to have a major, brutal [cut in retirement benefits]. In 2033, the Social Security trust fund is empty. Our best math is that first year of the shortfall is $616 billion. That’s just the shortfall. That is a 25% cut for seniors in 8 or 9 years. We will double senior poverty. How many people here do you see coming up and saying we’re going to fix it?”

On promoting disruption through technology to stabilize debt-to-GDP:

[Beginning at 32:47]

“There is a way to stabilize the debt-to-GDP [ratio], but it has to be done through policy. Those who look you in the eyes and say, ‘I can cut it and get there. I can tax and get there.’ They need to own a calculator, and I can give them some great literature to read. But there’s policy out there, and policy is hard because you’ve got to be willing to look at a number of the army of lobbyists, many of our constituents, many of the people here and say, ‘There is a reason you didn’t go to Blockbuster video last weekend.’ Technology creates revolutions. Instead now you hit a button at home and you stream. Those changes are already here that could dramatically change the cost of health care, radically change the cost of what it is to protect the environment, dramatically change the cost of building transportation. The technology, the engineering is here. But the laws we’ve passed, the way we reimburse things, we’re still defending the old model. If we want to save the country — we have dozens of things that are incredibly important — but I will argue we cannot survive a few more years of borrowing another $1 trillion every 140 days. If you want to understand what takes republics down, it’s ultimately when they have to inflate their currency, when they have to crush anyone with savings, destroy your kid’s future, your retirement. And that’s where we’re heading to. There’s hope, but every day we sit on our hands here, that hope gets a bit dimmer.”