Republicans mull aggressive move that critics call a blatant gimmick

WASHINGTON—The best things in life are free. Why not tax cuts too?

Republicans are readying an untested and aggressive move—a blatant gimmick, critics say—that would declare that Congress can extend expiring tax cuts and record no costs. House Republicans didn’t attempt the maneuver in the budget they passed this week. Key GOP senators are eager to try it.

Their push would likely lead to a high-profile Senate vote over a $4 trillion accounting question with significant implications for how deeply and permanently Republicans will cut taxes.

The idea—known by the lovely Washington name of “current-policy baseline”—has two main advantages for Republicans.

First, it makes a $4 trillion tax cut over a decade look like $0, which could be easier to sell to lawmakers and voters. Second, in the arcane Senate budget procedure world, declaring tax-cut extensions free opens Republicans’ easiest path to making President Trump’s expiring tax cuts permanent.

“We are going to do everything we can to put the current-policy baseline into place,” said Senate Finance Committee Chairman Mike Crapo (R., Idaho). “Current policy on taxes means we are declining or refusing to raise taxes.”

The reaction from Democrats, budget experts and a handful of Republicans has been withering. Rep. David Schweikert (R., Ariz.) has described the idea as a fraud and its proponents as lazy and intellectual scammers.

“Am I giving you enough inflammatory language?” he said. “I can actually go much further.”

Here’s the thing: Whether or not Republicans assume tax cuts have no cost, the endpoint of extending tax cuts would be the same when revenue and spending are tallied over the next few years. Assuming tax-cut extensions are free means acknowledging that today’s official debt projections are too low.

It is “telling yourself sweet little lies about how much deficit impact you’re going to have,” said Andrew Moylan, vice president of public finance at Arnold Ventures, an organization that favors making U.S. finances more sustainable. “It’s like telling your bathroom scale that certain calories don’t count.”

New measuring stick

Republicans find themselves here because of choices they made in 2017. Then, to pass tax cuts without Democratic votes, they used the process called budget reconciliation. That’s an expedited path around the Senate filibuster with a baroque series of limits on what qualifies.

Republicans capped their 2017 tax cuts at $1.5 trillion over 10 years and followed the requirement that reconciliation bills can’t add to deficits beyond the budget window. To hit those targets, they scheduled core provisions—including individual tax rate cuts, a higher standard deduction and a larger child tax credit—to expire after 2025.

They made a calculated bet that a future Congress would extend popular tax breaks. They are now that future Congress, regaining full control in last year’s elections and trying again to use reconciliation for tax cuts.

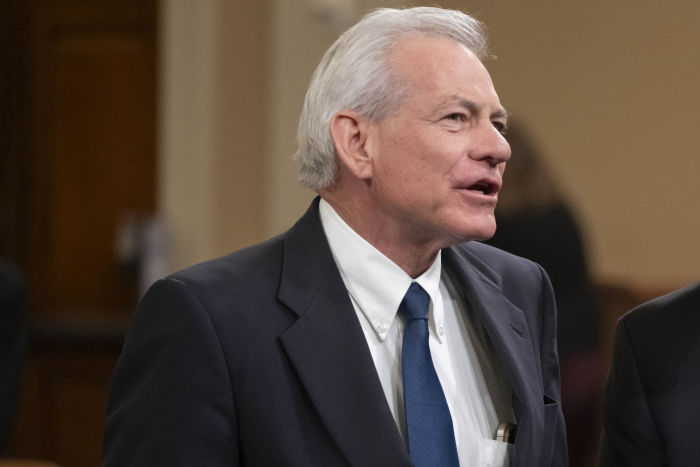

House Speaker Mike Johnson (R., La.) supports the idea that Congress shouldn’t consider tax-cut extensions a cost. Photo: will oliver/Shutterstock

The House plan uses the standard, consistent accounting approach called the current-law baseline. Because tax cuts aren’t on the books after 2025, official projections show revenue rising and deficits shrinking; changing that shows up as a revenue loss.

The House plan includes spending cuts and allocates $4 trillion to $4.5 trillion for tax cuts, roughly enough for a 10-year extension of the expiring tax cuts. They would, however, have a hard time making cuts permanent or including ideas like a higher cap on state and local tax deductions and Trump promises like “no tax on tips.”

Click here to read the full article.

By Richard Rubin // March 1, 2025 10:00 am ET

Back to News