WASHINGTON, D.C. — U.S. Representative David Schweikert (AZ-01) took to the House floor to deliver his weekly speech, presenting solutions that directly contribute to rising costs and decreasing wages in America. The Consumer Price Index (CPI) for November showed a 2.7 percent price increase from November of last year. Rep. Schweikert explained that wages are still down, and prices are evidently still up. He implored the American people, as well as his colleagues to prioritize a more modernized immigration system that promotes productivity and wage growth while, at the same time, contributes to our shrinking population and declining birth rates. Rep. Schweikert asks the question of why we invite people into our country just to educate them, when the next day we send them back to their country of origin in direct competition with America. When wages go up, we actually take in more tax receipts and then begins the cascade event of changing society and the economy for the future and the better.

Excerpts from Rep. Schweikert’s floor speech can be found below:

On modernization creating a pay-for, as well as preventing tax hikes:

[Beginning at 00:41]

“In the last fiscal year, our borrowing represented about 6.4 percent of the entire economy. When you have individuals around here saying, “Okay, we have these parts of our 2017 tax reform that expire at the end of next year.” If we just extend those, and don’t pay for them, it’s that [which] drives us to almost 9.2 percent of the entire economy nine years from now– nine budget years from now. If we actually find a way to pay for them and still extend those tax reforms, we get economic growth. If you just let everyone’s taxes go up, you end up– at the end of nine years– at about a little under 7% of the entire economy borrowed. It’s a little geeky, but the passion I tried to show here is I believe it’s the moral thing to do– we don’t let the portions on the middle class’s taxes go up next year, but we also step up and find a way to pay for it. The CBO and Joint Economic economists showed us last week if you paid for the tax extensions, at the end of the decade, the economy has gotten bigger. It will make sense. You would have taken $4.6 trillion out of the economy and use it for borrowing. You left it there so the small business, the big business, your family [has] money you can borrow to grow. And at the same time, your taxes haven’t gone up. It is hard for us to do because if we do modernization, if we find things to cut, there’s an army of lobbyists outside this door coming to scream at us. Some of those aren’t the people walking around with Gucci’s– they’re the people they fly in from our home districts and say, “David! We want that spending.”

On voters being conscious of the rising cost of living:

[Beginning at 04:29]

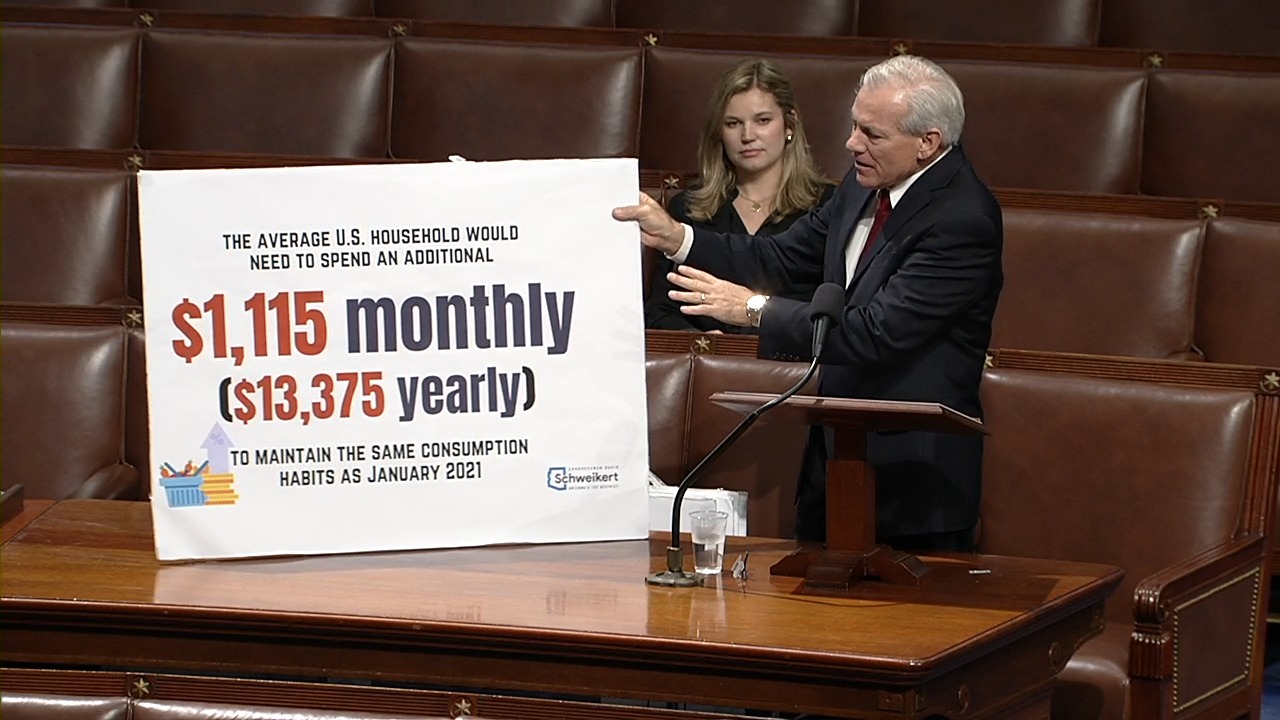

“Here’s the reality: if the president is looking at you in the camera, and telling you [we have] the best economy ever– that’s not factual– but why don’t you feel it? It’s because much of America is poorer today than the day President Biden took office. If you live in the Phoenix-Scottsdale area– my home– if you don’t make 27 percent more today than the day President Biden took office, you are poorer. Having someone telling you, “Oh, the economy is great,” and yet, you’re having trouble paying for things… The reason we made this board; functionally, for you to maintain your purchasing power, if you are an average American in my district– these numbers are substantially higher because I am from a district with some of the highest inflation in America– if you are not making $1,115 more a month– because that’s what you have to be [making] from four years ago– your purchasing power… you’re poorer. And I think that’s the reason that voters turned and said, “Okay, I see these Democrats running lots of ads saying crazy things,” but yet, it turns out the voters are actually really smart. They would look at their checking account. They’d look at the cost of their kids’ clothes. They’d look at the grocery store and try to figure out why in the last week of the month they were losing their minds under stress.“

On protecting research and development expensing in tax reform:

[Beginning at 21:32]

“One of the things that’s expiring from our 2017 tax reform is research and development expensing. [Let’s say] you’re a business and you’re researching a new way to make something. A new piece of technology. A new type of biology. A new cure for a disease. In 2017, what we did is we made it so you could expense it right then. In today’s tax code, you basically depreciate it. You spend a million dollars trying to build a new tool, and you get to amortize that research over the next seven years. Think about this: if I expense it in one day, or do it over seven years, government basically gets the same money, right? It’s just the timing. But if you have the ability to say, “I spent the money, I expensed it immediately,” what happens? You get this virtual cycle [of having] a new, better tool that’s better, faster, [and] cheaper. Then you jump on the next one, jump on the next one, and you get that productivity curve. Back to productivity again: how do you pay people more money? One of the complaints we were getting after 2017 is all this money was going into research and development to make society more prosperous, more modern– better, faster ways to cure people– and we had a shortage of people with skill sets. One of our economists is trying to model what would happen if you said we’re going to do expensing of research and development, because we know that pops economic growth, but if you also did talent-based immigration at the same time. You may get a multiplier effect. This is thinking like an economist. This is what we have to do to get ourselves out of this hole.“

Click here to view Rep. Schweikert’s full remarks.

###

Congressman David Schweikert serves on the House Ways and Means Committee and is the current Chairman of the Oversight Subcommittee. He is also the Vice Chairman on the bicameral Joint Economic Committee, chairs the Congressional Valley Fever Task Force, and is the Republican Co-Chair of the Blockchain Caucus, Telehealth Caucus, Singapore Caucus, and the Caucus on Access to Capital and Credit.