WASHINGTON, D.C. — U.S. Representative David Schweikert (AZ-01) presented his weekly House Floor speech today after a productive meeting with Elon Musk, Vivek Ramaswamy, and other members of DOGE. When someone like Musk is willing to engage in the hard conversations had yesterday, asking how to use technology to do it better, faster, cheaper, and dramatically more morally, there’s hope that more people are waking up and committed to the motive of not destroying the United States economy. Rep. Schweikert pointed out that many members don’t think of the morality of Congress’s place in the world. When there is a hiccup in the economy, the rest of the world gets a cold. If a debt crisis occurred, think of just how much of the world goes into mass poverty. Starting in 1990, the number of births in America started falling and now, society is aging fast. Rep. Schweikert urges to think like economists and understand that growth is not only moral, but it’s also the American birthright.

Excerpts from Rep. Schweikert’s floor speech can be found below:

Click here to view Rep. Schweikert’s full remarks.

On the lack of willingness of Congress to tell the truth to America:

[Beginning at 03:00]

“Just before we went on Thanksgiving– so, a couple [of] weeks ago– I held up this board saying, “Hey, we’re going to hit $36 trillion of borrowing in the next day or so.” I stand here with the same board from functionally two weeks ago… but it’s no longer $36 trillion. As of yesterday, it’s $36.17 trillion– meaning, in those two-and-a-half weeks since we last saw, we added another $170 billion of borrowing! At that current rate, we’re clicking off functionally $1 trillion every 105 days. [Of] all the people you’ve heard come to the microphone this week, how many of them came behind the microphone saying, “We’re going to borrow– every 100 some days– another $1 trillion,”? And there’s the crisis.”

On potential dangers of future U.S. bond sales on the world stage:

[Beginning at 11:15]

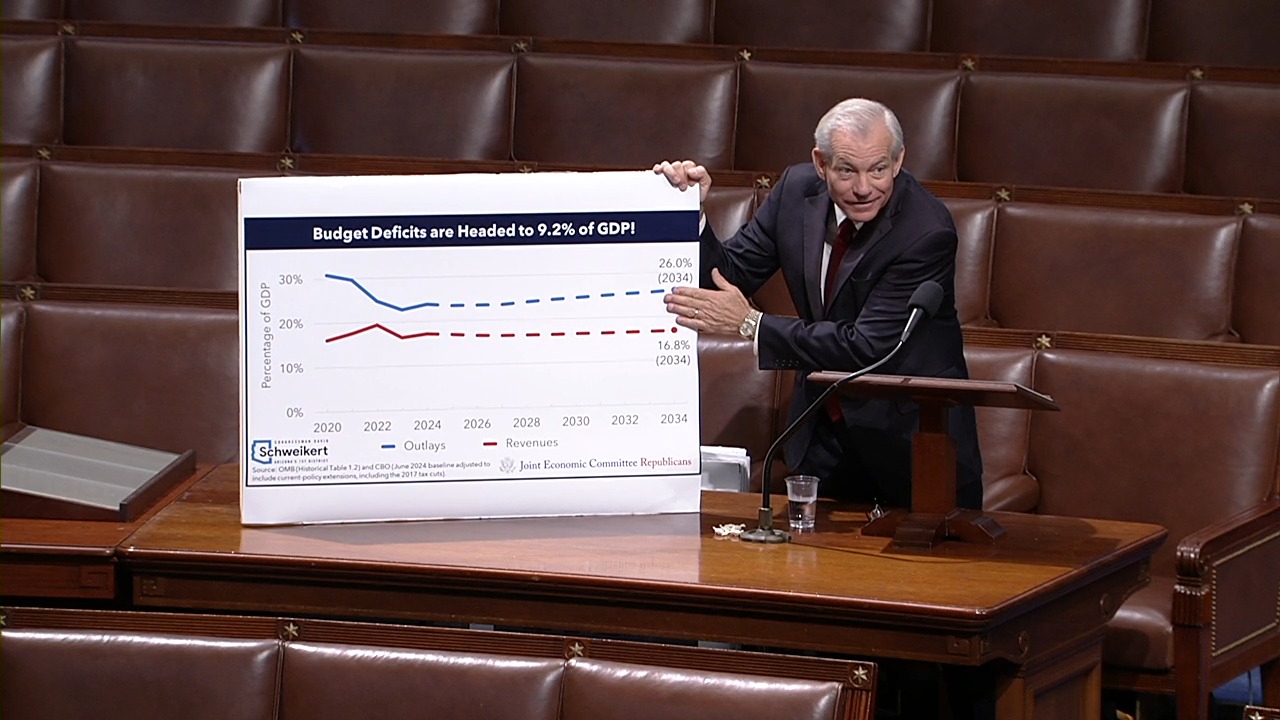

“This chart makes it clear: baseline, in nine years, we are borrowing 9.2 percent of the economy. If you read the political Washington press this week, we all know we have a huge tax issue we have to deal with. Parts of the 2017 tax reform that I was part of [with] Ways and Means expire– meaning, working people, LLCs, small businesses, partnerships, those things– all your taxes go back to the tax rates prior to 2017. First year, 2026, it’s about $400 billion. Over the 10 years, as we often talk about things here– let’s use $4.6 trillion. We have a number of members– more in the Senate– saying, “Don’t pay for it,” creating this language saying, “Well, we’ll say it’s policy baseline!” No, the law is that taxes are going up, [and] we should find a way to pay for it. If we do policy baseline– this is at the end of the decade where we are no longer borrowing 9.2 percent of the economy– [we] add about another point on that. Somewhere in the 10 percent of the entire economy will be borrowed every year. For people that are interested, [those] who watch world markets, and debt, and what’s going on in the world, how many of you remember this last summer what happened in Great Britain? Remember? They were going to lower taxes. I love lower taxes! What happened to the British pound? What happened to the British interest rates? Remember, the bond vigilantes showed up. What happened in France just two days ago? Remember, they were trying to do an austerity budget, just trying to get back to where they are mandated under the European union on their amount of debt they are borrowing. The government collapsed. What happened in South Korea? Remember, part of that battle was trying to do a budget because South Korea’s population is collapsing. Maybe we should actually have some introspection here of what’s going on with us and the world, and do you think the people that we sell our debt to are going to keep looking the other way and just keep buying it? Are they going to want premiums? Or are we going to have taken so much capital out of the economy [that] there is almost no growth?“

On the current administration impoverishing its own citizens:

[Beginning at 25:54]

“Today we actually have a pretty darn good economy! The GDP now, I think [as of] yesterday, we’re sitting at 3.2 percent GDP. That didn’t just magically happen. We can also see some of the giveaway money the Democrats did in the inflation reduction has had almost no true productivity impact. It turns out it was the allocations of the tax reform at the end of 2017. The problem is those provisions that got us that productivity are expiring. Some are substantially already expired. How do you deal with the concept of [having] no money, but [needing] to fix things in the tax code because we need the growth, but we need wage growth because we just finished an inflation cycle… in my community– the Phoenix-Scottsdale area– unless you make 27 percent more today than the day when Joe Biden took office, you are poorer. Think of that. You want to know why so many Americans are cranky? They’re poorer. It’s not enough to take credit for the economy being good. [That’s] great, but if your wages haven’t kept up with inflation, you’re poorer.“

###

Congressman David Schweikert serves on the House Ways and Means Committee and is the current Chairman of the Oversight Subcommittee. He is also the Vice Chairman on the bicameral Joint Economic Committee, chairs the Congressional Valley Fever Task Force, and is the Republican Co-Chair of the Blockchain Caucus, Telehealth Caucus, Singapore Caucus, and the Caucus on Access to Capital and Credit.