WASHINGTON, D.C. — Today, the House Committee on Ways & Means passed H.R. 3269, the Law Enforcement Innovate to De-Escalate Act, legislation that modernizes Federal firearms laws to account for advancements in de-escalation and less-than-lethal instruments, ensuring the continued innovation of lifesaving devices while keeping our communities safe. Current law states that less-than-lethal devices, such as Tasers, are defined as “firearms” under federal regulations and subject to the Firearms and Ammunition Excise Tax (FAET).

H.R. 3269 amends section 921 of Title 18 of the United States Code to ensure that a less-than-lethal projectile device, along with future technological advancements in the de-escalation device space, is not treated as a firearm for purposes of the Gun Control Act of 1968 (GCA) or the National Firearms Act of 1934 (NFA). This bill also requires the Treasury Department to submit an annual report on new and emerging technologies within this sector to ensure lifesaving devices do not face the bureaucratic burdens currently hindering the use of less-than-lethal devices from keeping our communities safe.

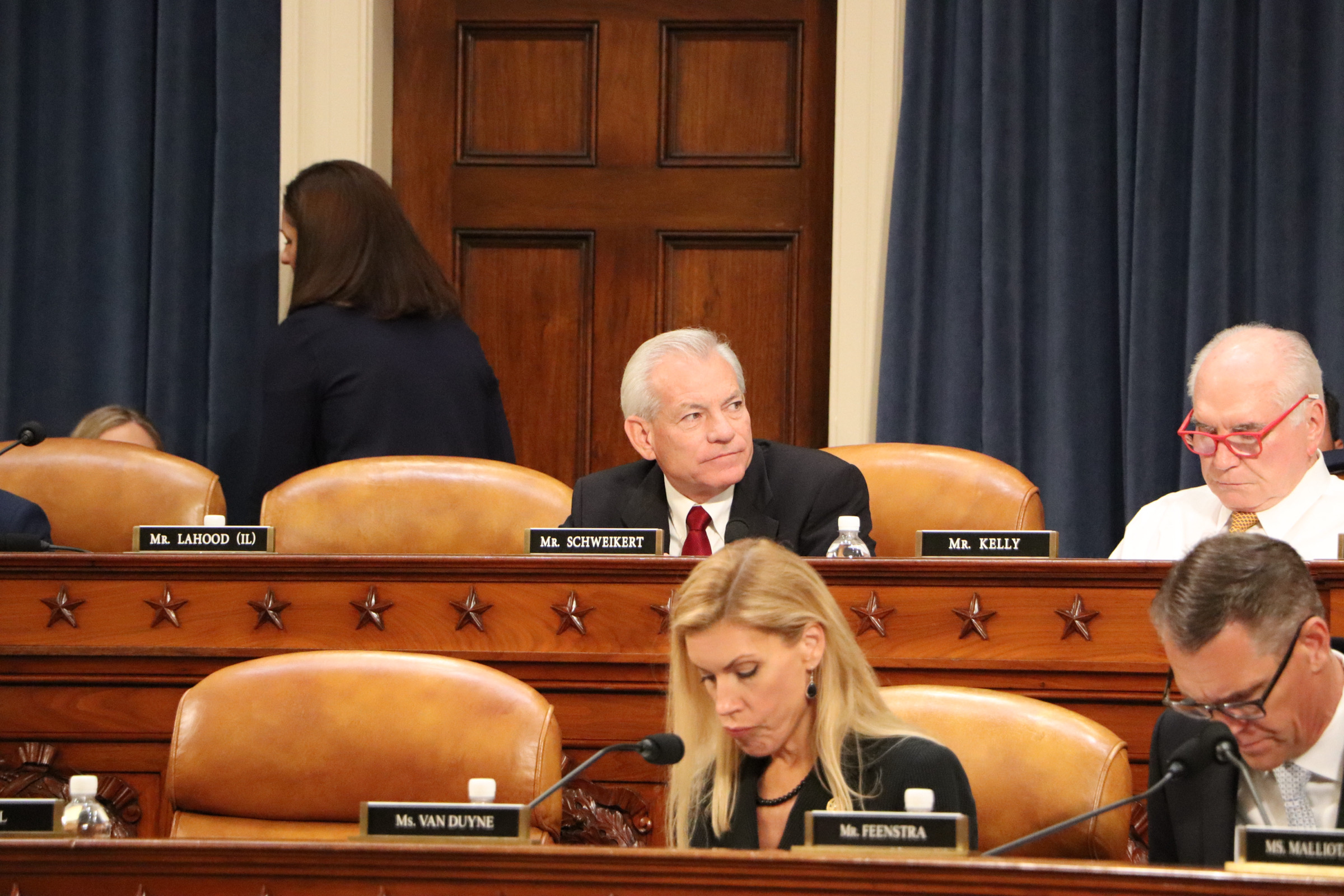

“Imagine a society where law enforcement is able to effectively protect our communities, without any lives being lost,” said Rep. David Schweikert [AZ-01]. “Aligning the tax code to meet the needs of our law enforcement officers and communities offers Congress the opportunity to reduce the chance of the use of deadly force and the unnecessary loss of life.Our ability to keep pushing forward to a world where such technology is available and robust has inspired this moral fix in hopes to solve part of the bigger societal issue, and I promise to continue advocating for this bill until it is signed into law.”

“We need many different tools to keep the peace and protect our communities,” said Committee Chairman, Jason Smith [MO-08]. “Unfortunately, inconsistencies in our laws and tax code have resulted in critical and innovative less-than-lethal devices such as tasers being taxed as firearms, making it costly and difficult to meet safety needs. The Law Enforcement Innovate to De-Escalate Act, sponsored by Reps. Schweikert and Stanton, will harmonize our tax code to ensure less-than-lethal technology is readily available and that our communities can keep pace with future innovations.”

Additional background on the Law Enforcement Innovate to De-Escalate Act (H.R. 3269)

- Currently, Title 18 of the U.S. Code, the Firearms and Ammunition Excise Tax, and the National Firearms Act imposes an excise tax on the sales by the manufacturer, producer, or importer of certain firearms and ammunition. However, the excise tax does not apply to machine guns and short barreled firearms.

- A “less-than-lethal projectile device” is a device with a bore or multiple bores that is not designed or intended to expel a projectile at a velocity exceeding 500 feet per second by any means, and is designed or intended to be used in a manner that is not likely to cause death of serious bodily injury.

Read the full bill text here.

###

Congressman David Schweikert serves on the Ways and Means Committee and is the current Chairman of the Oversight Subcommittee. He is also the Vice Chairman on the bicameral Joint Economic Committee, chairs the Congressional Valley Fever Task Force, and is the Republican Co-Chair of the Blockchain Caucus, Telehealth Caucus, Singapore Caucus, and the Caucus on Access to Capital and Credit.

Back to News