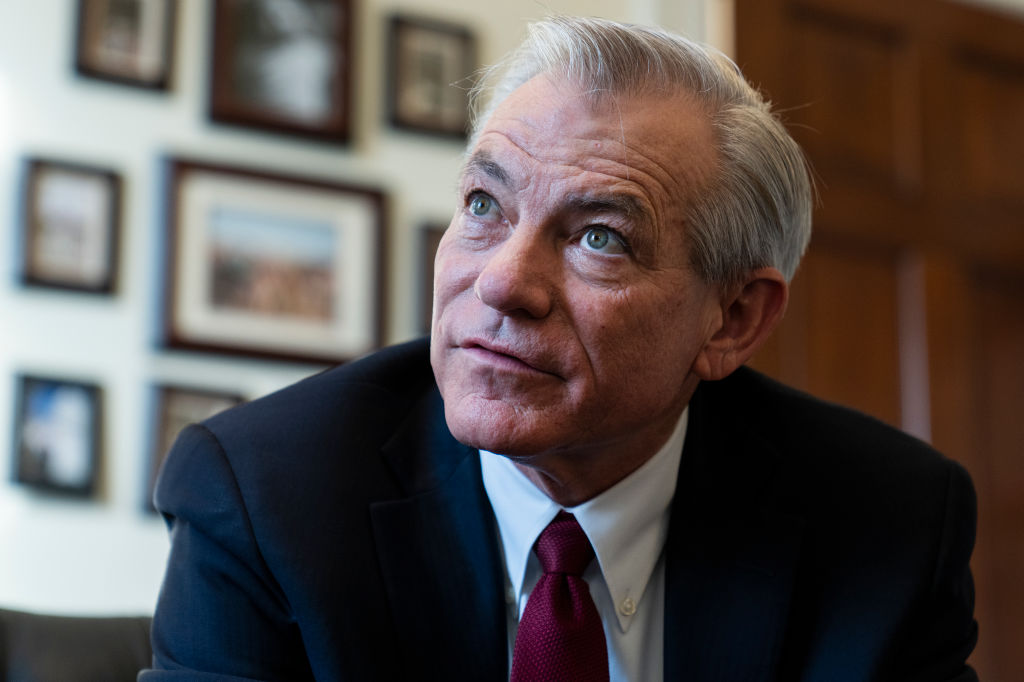

Rep. David Schweikert (R-Ariz.) has an expansive view of what he’s wishing will be up for debate when Congress tackles the expiring Trump tax cuts in 2025. He’s working now in the hopes that colleagues will think big next year.

We sat down with Schweikert – leader of House Republicans’ 2025 “New Economy” tax prep team – for the latest installment in our series of Q&A’s on the brewing tax fight.

For our Q&A’s, we’re asking key tax writers similar questions and selecting a few to spotlight each time. This interview was edited for length and clarity. Let’s get into it.

Q: What do you view as the biggest priority for your district in next year’s tax debate?

Schweikert: A level of stability and a tax code that sort of maximizes opportunity…

It’s sort of seeing it more holistically. One of my great fears right now is it’s becoming a binary question. So I do actually have a concern about the discussions on reconciliation where there hasn’t been enough economic discussion first for data on what could you do [with] policy other than just – these taxes go up, these taxes go down.

How much could you actually do as an offset through policy?

Q: I know your tax team is focused on a lot of issues like AI and crypto and what’s next. What are the biggest takeaways so far for things that you should be considering?

Schweikert: A lot of discussions have been based on defending incumbency, incumbent business models, incumbent tax systems…

We had one a couple of days ago that was really good because it was the first time we started to talk about things you could do tax policy-wise that were actually future-looking.

So one of my greatest concerns is listening to everyone and then prodding them to say, ‘Okay, I’m glad you’re here to talk about defending your current position in the tax code. What do you think your business model will look like five years from now? 10 years from now?’

Q: Do you think whatever tax bill there is next year needs to be fully offset?

Schweikert: The answer is yes, but my caveat is with appropriate scoring… The problem with our scoring models is you have members who will say, ‘Oh, it needs to be dynamically scored.’ It’s much more complex than that.

Because if you take my vision it’s okay, here’s tax policy, here’s this dynamic scoring to that. But the policy that’s associated with this may also – what would happen if you also have a policy part of it that brought a cure to market faster? Do you get some value for that?

So I would argue for a much more complex type of model.

Full article here.

Back to News