WASHINGTON, D.C. — U.S. Representative David Schweikert (AZ-01) delivered a speech on the House Floor last night to explain that every dime that Members of Congress vote on is now on borrowed money, and that spending on interest will eclipse $1 trillion in Fiscal Year 2024, becoming the second largest expense in all of government. Rep. Schweikert also urged his colleagues to tell the truth about the math instead of continuing to ignore the nation’s fiscal challenges.

Excerpts from Rep. Schweikert’s floor speech can be found below:

Click here or on the image above to view Rep. Schweikert’s remarks.

On the notion that every dime that Congress votes on is on borrowed money:

[Beginning at 4:58 mark]

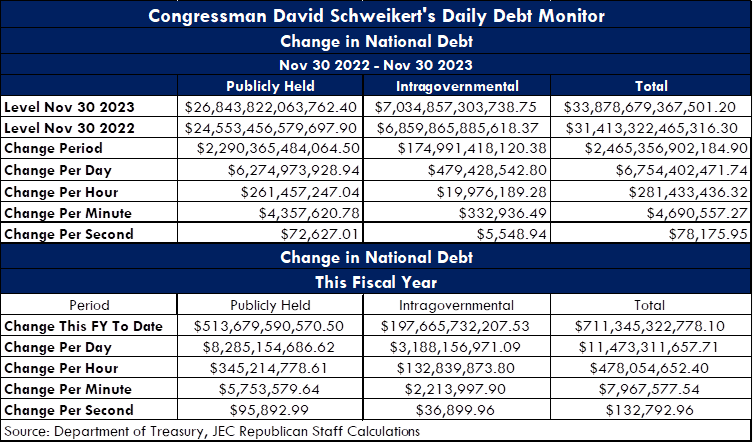

“Last year, every dime of non-defense [spending] was borrowed, every dime of [defense spending] was borrowed, and about $400 billion of [mandatory spending] was borrowed. Every dime a member of Congress votes on is borrowed money, plus a chunk of mandatory [spending]. Think of that. If you said, ‘I’m going to balance the budget,’ God bless you. First, you’ve got to shut down the defense system — the Defense Department’s gone. You’ve got to get rid of functionally all of government, and you’ve got to figure out what $400 billion you’re going to remove from Medicare. That’s the math. The math will win. The math is the truth. […] You’ve got to understand the scale. And if someone tells you we’re just not taxing rich people enough, huh? Or someone’s going to tell you, ‘Hey, it’s foreign aid and waste and fraud.’ Fine. Get rid of both. Go after waste and fraud. We should be vicious on it. But don’t pretend that it does anything. I think we did a calculation last year, and foreign aid was, like, 7,8, or 9 days of borrowing. Now we’re borrowing $6.5 billion a day.”

On interest spending becoming the second largest expense in all of government:

[Beginning at 9:51 mark]

“If you’re from the Phoenix-Scottsdale area and you haven’t had about a 22% pay hike in the last 30 months, you are poorer today, and then you wonder why there’s such stress out there in our society. So, if I came to you right now and said, ‘What is the number one spend in all of the United States government?’ It’s Social Security. This year we’re going to spend about [$1.45 trillion on Social Security]. The punch line on this slide is I want you to understand gross interest — that is interest we pay to people who have bought U.S. bonds, also the interest when we borrow money, when the Treasury borrows money out of Social Security, we pay interest. Interest will be over $1 trillion this year. Interest in the United States this year is the second biggest spend. The third biggest spend is not defense, it’s actually Medicare now. The growth rate of Medicare and interest are the primary drivers of future spending. Defense is now the fourth [biggest spend]. So every time you run into a leftist who [just wants to cut defense], could you remind them it’s actually number four now on the hierarchy of spending? If I told you this chart a couple of years ago, you would have thought I was out of my mind. It’s happened. Gross interest this year will top $1 trillion, and the net interest to outside bondholders now is well over $800 billion. You do realize just the net interest is going to be more than defense? Why is this not our fixation? Why are there people who are terrified of a debt commission to actually tell the truth about the math?”

On utilizing disruption to unleash GDP growth:

[Beginning at 27:41 mark]

“Here’s your policy split. The Left wants tax hikes. The Right — and I’m one of them — wants spending cuts. Okay. You can maximize both of those, and it doesn’t get you close. You have to do policy. Policy is hard. Policy requires thinking. Policy requires saying no to people that might contribute to you. Policy says I need you to actually read something. There are things you can do.

“If we could disrupt the cost of so many things in our society, whether it be health care, whether it be the way we do regulation, you could actually set off GDP growth. You could lower the cost drivers of this government. By doing that, you lower the cost of the financing. You tell the bond markets how serious we are. Maybe they give us some love and credit on our interest rates. There is a path where this can work. You just need members of Congress to deal with the reality. Tell the truth about the math.”