WASHINGTON, D.C. — U.S. Representative David Schweikert (AZ-01) delivered a speech on the House Floor today to hammer home the fact that gross interest will climb above $1 trillion this fiscal year, making interest the second largest expense in all of government. Rep. Schweikert also explained that the Social Security trust fund runs out of money in nine years, setting in an automatic 25% cut in retirement benefits and risking the doubling of senior poverty if Congress continues down an unsustainable fiscal path.

Excerpts from Rep. Schweikert’s floor speech can be found below:

Click here or on the image above to view Rep. Schweikert’s remarks.

On the Social Security trust fund running out in nine budget years:

[Beginning at 3:52 mark]

“This fiscal year, the number one spend will be Social Security. Now, let’s talk about this for a moment. Social Security is its own trust fund — its own funding mechanism. None of the money is spent in the general fund. It’s loaned to the general fund, and Social Security gets the special Treasury notes, and then they’re paid interest twice a year. If you ever geek out, and you’re someone that watches U.S. debt, and all of a sudden there’s this sudden spike, often that’s actually because we made our twice-a-year interest payments to Social Security — but it’s separate. But you’ve also got to understand the flip side of that. In nine years, when the Social Security trust fund is empty, it doesn’t have a claim on the general fund either. […] CBO says a 25% cut in your check is coming in nine years. The average couple in America on Social Security [will take a] $17,400 cut. We will double poverty of the senior population in America. It’s immoral, and the solution we get is just raise these taxes, do the cap. […] Right now, it looks like raising the cap on Social Security, doing these other mechanisms, still does not close that $616 billion shortfall. That’s the very first year the Social Security trust fund is gone. Why [isn’t this] talked about constantly here? When defense is like $830 billion and just the shortfall in a single year for Social Security is over $600 billion, does anyone see the scale we’re talking about?”

On every dime that Congress votes on is borrowed money:

[Beginning at 9:38 mark]

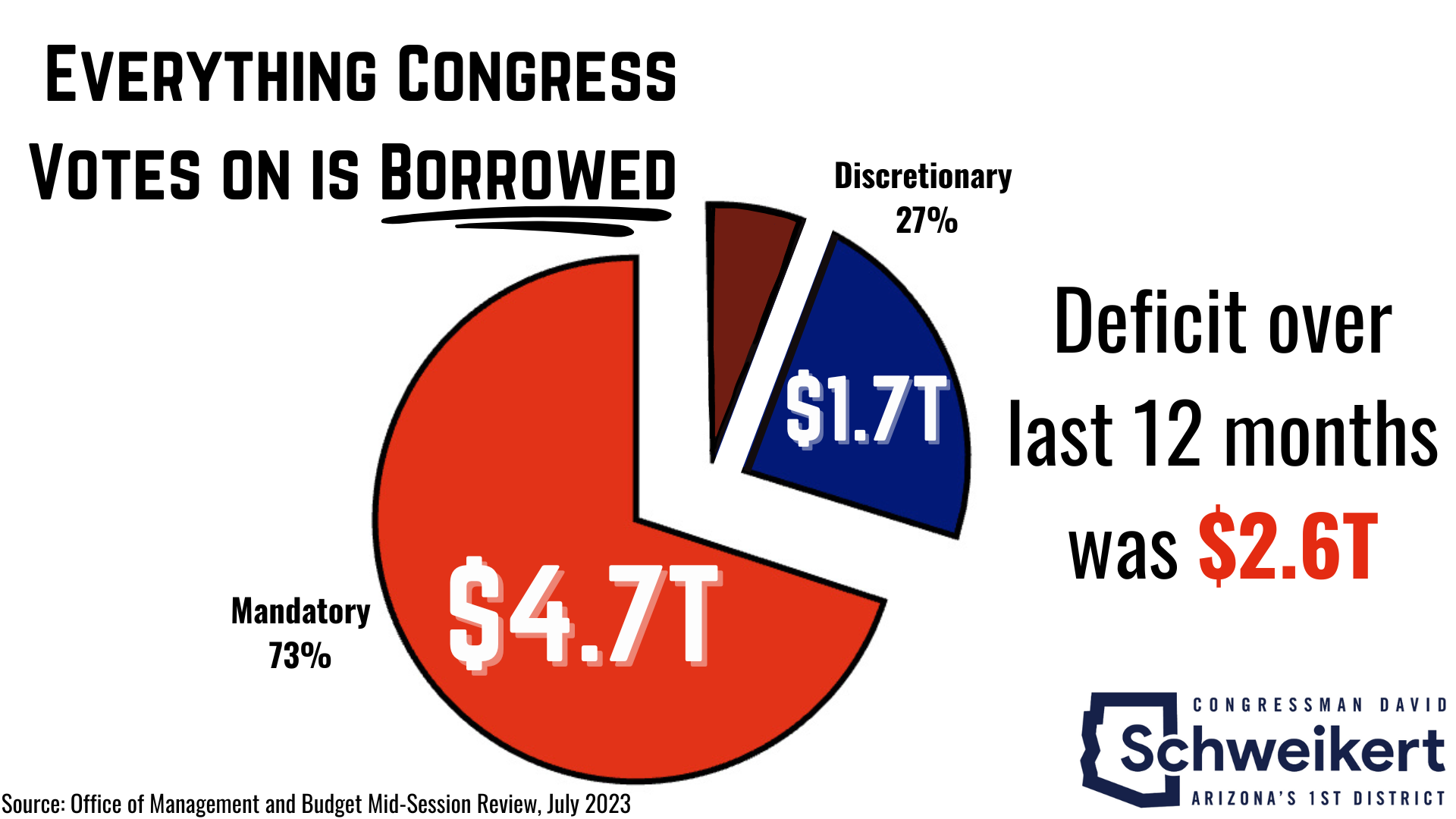

“The number of folks who have lived in this sort of mathematical fantasy world — you see this red here? This is last year’s spend. 73% of the federal government’s spending was on autopilot. We don’t get to vote on it. You get elected to Congress. You do not vote on 73% of all the spending because it’s [formula-based]. You worked your 40 quarters, you get the Social Security [benefits]. You hit a certain age and participate, you get your Medicare [benefits]. You’re part of a certain tribal group, you get this. These are things that it’s [formula-based]. You fall below a certain income, you get these. Defense was 13% of our spending last year. […] But the fighting that ultimately removed [Speaker McCarthy] is over this little green wedge here. That’s 15%. The punch line you need to just burn into your mind — all this green is borrowed. All this blue is borrowed, and last year, about $400 billion of the red was borrowed. Everything a member of Congress votes on is borrowed money. Sink that in. Everything we vote on is on borrowed money.”

On borrowing costs eclipsing $78,000 per second:

[Beginning at 13:09 mark]

“What would you guess we’re borrowing per second? I think as of yesterday, we were at $78,480 per second. You can sign up on our website and get this wonderful text message sent to you every day with the actual facts. The number of times I hear people speaking behind these microphones, and you’re pulling out your calculator and going, ‘Where’d they come up with that?’ They just make things up because these numbers are so difficult. So far this fiscal year, and it will change as tax collections come in, we’re over $112,000 per second in borrowing. And of that $78,000 we’re borrowing right now per second over the last 364 days, $30,000-$35,000 of that now is interest, and it gets worse because lots of the bonds we sold over the last couple of years — because we’re idiots — we sold short on the curve. So, we had incredibly low interest rates, and now those bonds are going to have to be refinanced at these higher interest rates.

“Three weeks ago, we had a 30-year bond auction where the broker dealers — the market makers — had to take 24% of it. Now, everyone that’s listening, you just went, ‘huh?’ What happens when there are so few buyers, or there’s so much inventory that has to be sold, that the broker dealers don’t have enough credit line to take it all down? Does that become a failed bond auction? Do we start to see stress in the world bond market? Remember, the entire world uses our bonds as the oil, the liquidity that keeps financial markets working here and around the world, our mortgages, everything else. Intellectually, I don’t think we understand the serious nature of what a chart like this tells you. When you start looking at gross interest just marching along, and then this is functionally the last 12 months. So, you had some of the lower interest rates in the beginning of 2023. Remember, interest rates didn’t really start to move until April of last year. This is showing just in the last 12 months, we functionally added $923 billion in financing costs on those interest rates. This year, it’s going to be over $1 trillion. But then you come over here, and you start even looking at things like net interest. Net interest is ultimately going up. The two lines are meeting. Why? Because the trust funds are getting smaller and smaller because they are shrinking. Remember, the Transportation trust fund is gone in a few years. Medicare Part A, the hospital portion, is gone in seven years. Social Security is gone in nine years. You’ve got to understand that also has an effect on our borrowing because we can’t borrow internally.”